Smart contracts for container based video conferencing services: Architecture and implementation

Sandi Gec, Dejan Lavbič, Marko Bajec and Vlado Stankovski. 2018. Smart contracts for container based video conferencing services: Architecture and implementation, 15th International Conference on the Economics of Grids, Clouds, Systems, and Services (GECON 2018), 18. 9. 2018 - 20. 9. 2018, Pisa, Italy.

Abstract

Today, container-based virtualization is very popular due to the lightweight nature of containers and the ability to use them flexibly in various heterogeneously composed systems. This makes it possible to collaboratively develop services by sharing various types of resources, such as infrastructures, software and digitalized content. In this work, our home made video-conferencing (VC) system is used to study resource usage optimisation in business context. An application like this, does not provide monetization possibilities to all involved stakeholders including end users, cloud providers, software engineers and similar. Blockchain related technologies, such as Smart Contracts (SC) offer a possibility to address some of these needs. We introduce a novel architecture for monetization of added-value according to preferences of the stakeholders that participate in joint software service offers. The developed architecture facilitates use case scenarios of service and resource offers according to fixed and dynamic pricing schemes, fixed usage period, prepaid quota for flexible usage, division of income, consensual decisions among collaborative service providers, and constrained based usage of resources or services. Our container-based VC service, which is based on the Jitsi Meet Open Source software is used to demonstrate the proposed architecture and the benefits of the investigated use cases.

Keywords

Blockchain, Video-Conferencing, Container, Monetization, Smart Contracts

1 Introduction

Resources, such as computing infrastructures, Cloud services offers and software (Web servers, libraries and so on), combined together represent basis for the provisioning of high-quality software services. The various stakeholders usually need to collaborate in order to be able to produce such software services. This particularly requires mechanisms for assuring monetization of the contributed added-value, transparency, security, trust, Quality of Service (QoS) assurance through Service Level Agreements (SLAs), and so on.

In order to facilitate flexible provisioning and consumption of resources and services, it is necessary to address various SLAs and monetization use cases of the stakeholders. In this study we concentrate on the analysis and implementation of various monetization approaches to collaboratively provide comprehensive software services to the end users. This includes SLA offers according to a fixed and variable pricing model, time-limited and quota-based provisioning, constraints-based access, revenue sharing, and other mechanisms making it possible to engineer and deliver software services with sufficient business flexibility. The goal of the present study is therefore to develop and evaluate an architecture that can be used to automate the process of software services provisioning and consumption.

Our approach relies on recent trends in the financial domain. Traditional currency transactions among people and companies are often facilitated with a central entity and controlled by a third party organizations such as banks. Bitcoin as a first decentralized digital currency was presented and launched as an alternative to centralized solutions. It is based on the Blockchain technology and has many benefits (Anjum, Sporny, and Sill 2017). Through the adoption of Bitcoin among the world population the Blockchain technology presents opportunities in many areas, such as the Internet of Things, Cloud computing and software engineering in general. This has led to the launch of new dedicated cryptocurrencies – Ethereum1 as a Smart Contracts (SC) ledger, IoTa2 as an Internet of Things-based (IoT) ledger, Ripple3 as a transaction cost optimization ledger, ledgers for anonymous transactions, protocols and other Blockchain systems covering a plethora of use cases. For example, in the Cloud domain the distributed storage system StorJ4 is an alternative to commercial storage solutions such as Amazon S3 storage, Google Drive or Dropbox, and provides the same types of services with high encryption security and full transparency.

In this paper, we propose a new Cloud architecture for Container Image (CI) management containing a Web based Video-Conferencing (VC) application that assures high QoS and exploits the benefits of the Blockchain technology as a key component that differs from other existing solutions. Some key technologies, such as SCs, that are part of the architecture, are used to fulfill functional requirements, such as the needed agreements among the user and system roles. These are described in the following sections. By developing solutions for several generic monetization use cases, we aim to cover a potentially large number of stakeholders accordingly with their usage preferences, such as regular, occasional, demanding users and similar. This new architecture is designed having in mind the requirements for security, transparency and various monetization approaches through the use of SCs. The new architecture is implemented for one VC applications on top of Blockchain. This makes it possible to empirically compare it with traditional monetization approaches quantitatively and qualitatively.

The rest of the paper is organized as follows. Section 2 positions our work among other related works. Section 3 introduces Blockchain and Cloud computing in relation to the economy aspect. Section 4 presents and overview of the use cases based on using Blockchain. Section 5 presents the new architecture and its implementation. Section 6 presents a detailed overview of dynamic price monetization and explains the detailed workflow among the software services. Section 7 explains the relevance and significance of the obtained results, discusses the lessons learnt and provides some conclusions.

3 Background

Blockchain and SCs are technologies underpinning the design and implementation of our new architecture on top of which our Jitsi Meet6 based VC system is provisioned. Blockchain (originally named block chain), is a continuously (time-based) growing list of records, called blocks, which are linked and secured using cryptography mechanisms (e.g. Bitcoin uses SHA-256). Each record ordinarily contains metadata – a reference (cryptographic hash) to the previous block, timestamp and transaction data. Blockchains are secure by design through broker-free (P2P-based) characteristics. Therefore, the alteration of the content in the blocks by single or even multiple node entities is very difficult to happen due to the high distribution rate. To summarize, key properties of the Blockchain are elevated distribution, no central authority, irreversibility, accessibility, time-stamping and cryptography.

Smart Contract (SC) is a digital variation of a traditional contract which can be described as a protocol intended to digitally facilitate, verify and enforce the negotiation or performance by implementing arbitrary rules. In the design of our novel architecture, we rely on the Ethereum network with the built-in fully fledged Turing-complete programming language Solidity, which is used to design and implement SCs.

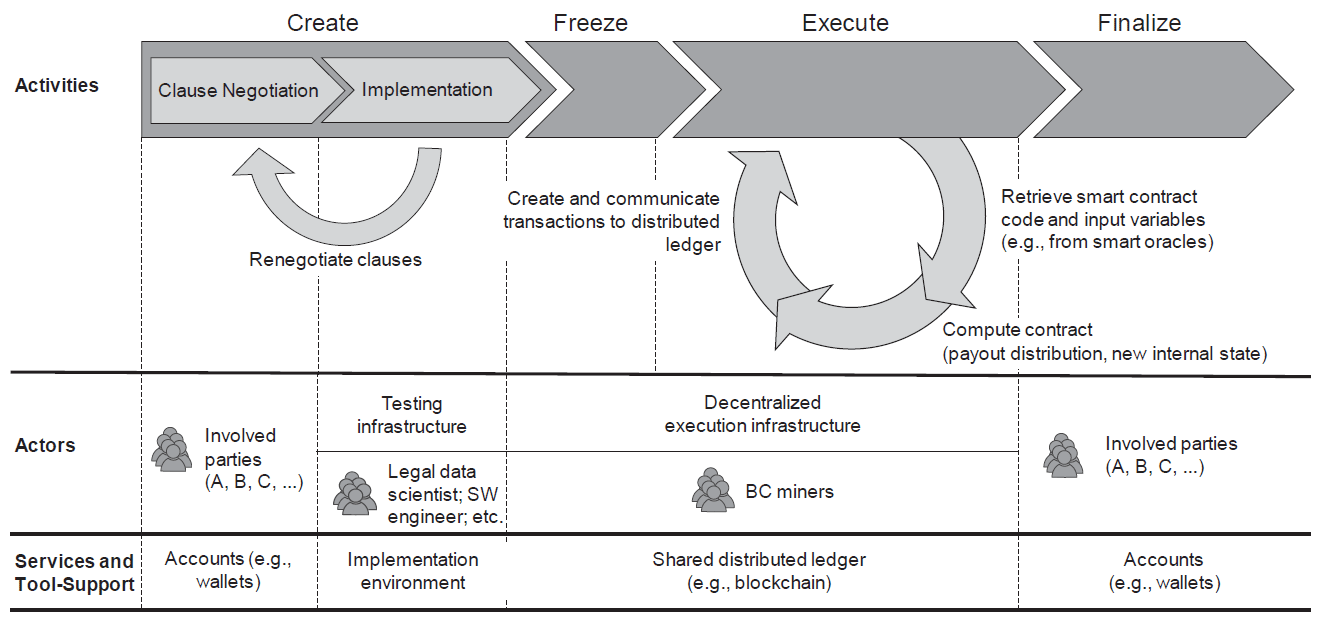

The life-cycle of a SC can be summarized in the following example. A developer designs a dedicated SC or uses an existing one. By doing that SC is considered as a template that is desired to be at least validated through specific tools. Each SC template may be deployed on a desired address to a production (mainnet) or development (testnet) network. Upon deployment the SC invokes the constructor only once, while the address owner usually has higher privileges, for example, it can destroy the deployed SC instance. Other participant, public or specific addresses, can trigger a SC instance through the supported functions that lead to sending of another transaction, triggering another SC, theoretically ad infinitum as illustrated in Figure 3.1.

Figure 3.1: The life cycle of a smart contract: phases, actors, and services (Sillaber and Waltl 2017)

In order to understand the monetization in the Cloud services domain we first need to know the economic ecosystem of the resources, services and environments deployed in the Clouds. In the first place, such environments must consider the total cost of ownership for the on-premises by considering the cost of the resources, equipment, computing and networking infrastructures, capital and the resources and services lifespan. All of these aspects can be described as the operational and maintenance costs of the services running on demand. Currently, there exist various special-purpose monetization services available, such as YouTube channel monetization, mobile applications advertising monetization and similar, which commonly have relatively expensive operational costs. It may therefore be possible to implement a flexible Blockchain monetization overlay on top of Cloud services.

In this paper, we focus on several use cases and requirements for monetization of a specific container-based VC service as an architectural overlay that may satisfy different types of end users. The developed architecture and its implementation is described in detail in the following section 4.

4 Video-conferencing application, use cases and requirements analysis

In this work we rely on advanced technologies, which are used in Cloud computing including Docker7 for the management of containers, and Kubernetes8 as a general purpose orchestration technology. Our VC application Jitsi Meet is therefore packed into Docker containers. In contrast to VMIs, containers can be spinned on and off much faster, practically within seconds, thus forming basis for fine-grained services orchestration, which is driven by various events (such as end users that need to run a video-conference). Whenever a specific software service is required, these services make it possible to dynamically deploy a container image and serve the particular end user or event.

Our goal was to study different monetization approaches that can be used by the stakeholders that contribute resources and services in order to develop a working VC software service. We present a basic comparison between conventional and Blockchain monetization on the Ethereum network.

In order to ensure feasibility of the monetization method applied in our system, we summarized basic properties of the Ethereum network and compared them with three popular payment systems: Visa, Mastercard and Paypal. The comparison results in Table 4.1 show that the overall cost of Ethereum monetization is significantly lower compared to traditional methods. Ethereum transaction cost represented with GWEI unit where \(1\) ETH = \(10^9\) GWEI, is tightly dependent by the following factors: Ethereum network congestion, preferred transaction speed and the actual price of ETH coin. To minimize the ETH coin volatility there is a dedicated ERC20 token TrueUSD9, which is an USD-backed, fully collateraized, transparent and legally protected. In addition to lower absolute transaction cost, SCs allows much more flexible transactions. For example, lock-in of transaction funds refers to the actual locking of funds in the SC till certain functional conditions has not been reached and releasing the funds, or just fractioned funds, to the appropriate user entity.

| Monetization method | Transaction processing fee | Merchant or operational service cost [USD] | Lock-in of transaction funds |

|---|---|---|---|

| Visa | \(1.43\%\) – \(2.40\%\) | min. \(1.25\%\) | limited |

| Mastercard | \(1.55\%\) – \(2.60\%\) | min. \(1.25\% + 0.05\) | limited |

| PayPal | \(2.90\%\) – \(4.40\%\) | min. \(1.50\%\) | limited |

| Ethereum | \(1\) – \(40\) GWEI10 | \(0\) | flexible |

The monetization processes for our VC system from the viewpoint of the various stakeholders was described with several use cases as follows. The use cases describe different user needs based on actual usage patterns of resources and services. These can be achieved through the definitions of SCs. Another important aspect, which is considered concerns the income division among the parties, including the Cloud providers, container image deployment platforms, infrastructure providers and so on. In order words, we analyed the needs of all stakeholders who are in charge for an individual VC service setup processes. Following are seven identified monetization use cases that can be supported by Blockchain and Ethereum SCs.

Fixed price is the most basic definition of the use case. The VC system, depending on the QoS end user’s requirements, offers the usage of VC service for a fixed price and fixed maximum period of time on demand. The agreement is reached when both parties signs the SC while the end user sends the required ETH funds.

Dynamic price in addition to fixed price use case, offers higher flexibility of the actual VC service availability. For example, the end user knows the maximum time that that he/she might need the VC service. After the agreement is reached the user pays the full price but the Ethereum funds are locked by the SC. The fund become unlocked if the maximum period is reached or if the end user stops using VC service by confirming the SC. In the unlocking phase the actual usage time is charged – the proportional Ethereum of unused time is returned to the end user while the rest is sent to the VC service.

Time-limited usage refers to the use case when the end user in advance agrees the per-minute conversation price, buys certain VC session minutes and uses the VC service gradually on demand. A typical usage is suitable for Big Brother-like TV shows and other content provided in real-time online.

Flexible usage period offers more flexibility for the end users that cannot define the exact period when the VC service will be used. In the proposed end user’s period, the VC service has to be either available or the deployment of the VC service has to be optimized and thus very fast. The charge methodology follows the dynamic price use case and the SC contains also the minimum charge price for maintaining the fast deployment of the containerized VC service for the specific time period.

Division of income is a particular monetization process where the parties involved are those who enables the VC service hardware and software infrastructure. For example, one provider offers specific VC containers, another offers infrastructure and the third provider offers other services, such as monitoring. The division of income is agreed upon the parties in advance and validated through the SC. An overall advantage of this approach for the end user is reflected as a lower overall price of the VC service.

Consensus decision is an upgrade to division of income use case. The consensus is reached through a democratic voting SC, similar to the one proposed by Bragagnolo et al. (2018). As a result the management of VC service is divided among parties specialized for different HW/SW and service aspects and thus improved QoS/QoE, availability and overall cost reduction.

Constraint based focuses on the legal aspects determined by the end user’s constraints. As an example EU General Data Protection Regulation (GDPR) compliant can be agreed by all end users through SC. In some cases geographical definition is also important and should be determined by the end user and VC system in advance (e.g. not all data services are allowed in specific countries). In general, by constraint limiting, either the price for the end user, either the potential QoS, changes (VC service price increase, decreased QoS) in the proposition of SC by the VC service.

In order to summarize, the rough analysis of the main properties of the monetization use cases addressing the various requirements are presented in Table 4.2.

| Monetization use case | Minimum required SCs | SCs functions [description (SC)] | Roles involved |

|---|---|---|---|

| Fixed price | \(1\) | set price by owner, sign agreement | VC system, end user |

| Dynamic price | \(1\) | set price by owner, sign agreement, stop VC service | VC system, end user |

| Time-limited usage | \(1 + n\) (\(n\) are number of accesses) | set price by owner \((1)\), sign agreement \((1)\), start VC session \((n)\), stop VC session \((n)\) | VC system, end user |

| Flexible period | \(1\) | set price by owner, sign agreement, stop VC service | VC system, end user |

| Division of income | \(2\) | set price by all VC enabling entities \((1)\), set price by owner \((2)\), sign agreement \((2)\) | VC service enabling entities, end user |

| Consensus decision | \(2\) | set voters \((1)\), vote by all VC enabling entities \((1)\), set price by owner \((2)\), sign agreement \((2)\) | VC service enabling entities, end user |

| Constraint based | \(1\)) | delegate constraints by owner, set price by owner, sign agreement, stop VC service | VC system, end user |

5 Blockchain based architecture for flexible monetization of Cloud resources and software services

The proposed architecture consist of various components that are packed as Docker CI. In order to address the proposed monetization use cases, we extend the existing VC architecture which includes an orchestrator (Paščinski et al. 2018). While the focus of our previous work was the design of a Cloud based orchestration system that provides an intelligent delivery of two network intensive applications (File Upload and VC), the focus of the present work addresses the needs to facilitate flexible usage of the resources and software related to the provisioning of the VC service. We present an architecture to facilitate the VC application through the use of the Blockchain technology.

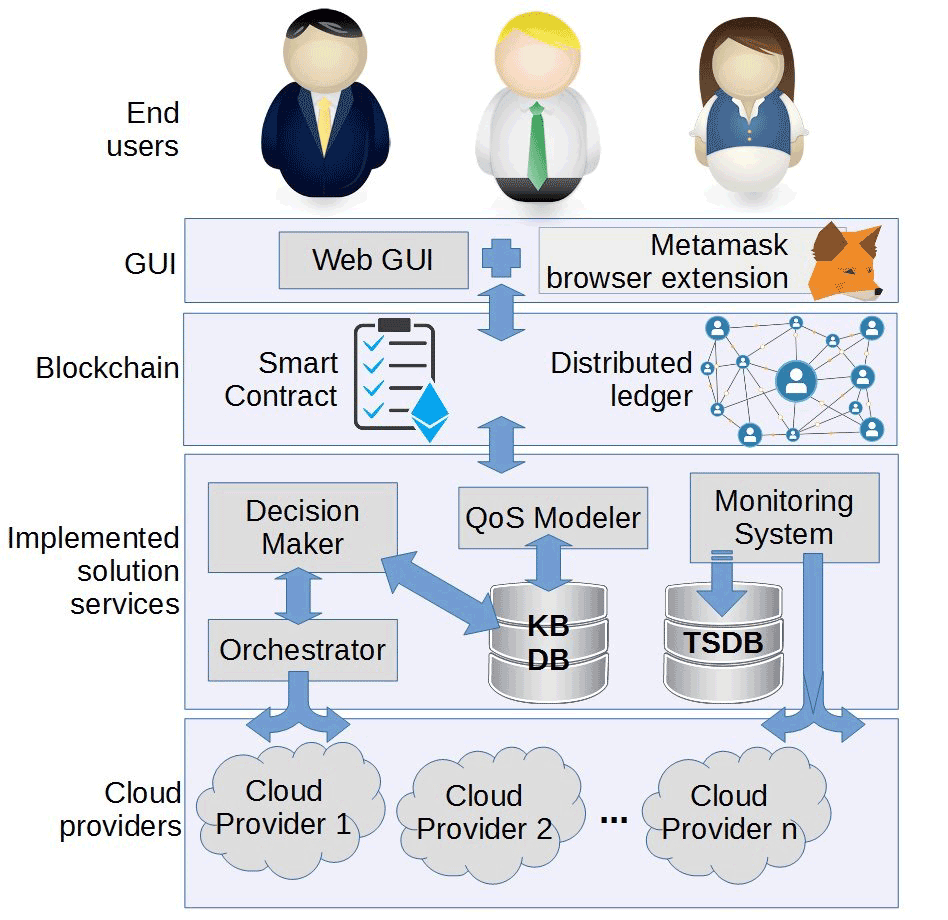

The novel architecture enables different monetization approaches among four pillar component layers:

- Cloud providers,

- Implemented solution services,

- Blockchain components and

- Graphical User Interface (GUI).

The implemented architecture is depicted in Figure 5.1 and its main components are explained in the following.

Figure 5.1: High-level architecture of a SaaS VC use case

Cloud providers are available on different geographical locations and are used for the deployment of VC service instances. The VC application components, which are packed into Docker containers can be deployed on demand when an agreement between the end user and the VC service provider is reached, and thus follow the SaaS delivery method. Besides, the deployed VC application instances can be monitored to provide metrics, such as usage time period and other QoS metrics that can be included in an SLA.

Implemented service solutions are composed of different components that comprehensively perform different tasks. For example, to estimate the potential QoS of the deployed VC service it is mandatory to have QoS metrics defined and measured, while the VC service is running. By doing this, the QoS metrics are modelled, while the Decision Maker identifies potential Cloud providers, where the container image should be started.

Blockchain components consist of a public Blockchain ledger, i.e. Ethereum and our developed SC templates supporting the proposed monetization use cases. See Section 4 for details. The distributed node infrastructure is maintained by the Ethereum community and offers a high level of distribution and availability. The main API technologies are written in the Java programming language, thus the core Ethereum bridge is the Java library ethereumj11 embedded in the core layer API. The deployed SC instances may be triggered by end users and VC system. In all SC trigger executions and phases are updated by the actual content in the Ethereum blockchain network.

Web based GUI is the main entry point for the end user. Each VC session consists of an end user subscriber and other participants. The subscriber in the Web GUI defines the preferences with QoS metrics and submits the request that is delegated to the backend component. According to the end user’s preferences, the SC terms are proposed to the end user by our system. In all monetization use cases the agreement is reached when both parties signs the SC.

The general workflow of the architecture consist of the agreement among an end user and the VC service to determine the monetization use case, QoS user’s requirements and the price. After the VC service deploys the CI application components, the end user gets unique URL for the VC session. The application life-cycle is completed when the end user finishes using the VC application or if any other condition occurs, e.g. the VC session time is exceed. In addition the resources are freed by the undeployment of VC session service on the Cloud providers’ infrastructure. In the final stage the Ethereum SCs are signed by both parties, the end user and the VC service, and thus the final monetization flow is executed. A complete workflow with the dynamic price monetization use case is presented in the following section 6.

6 In-depth analysis of the dynamic price monetization use case

In this section, we systematically describe the dynamic price monetization workflow, which is used by our VC software service. The selected use case is motivated by the transparent definition of the agreements among end user and VC system through an Ethereum SC.

The aim of the dynamic price monetization is increased flexibility for the end user, who cannot estimate the exact duration of the needed VC session. In comparison to traditional monetization methods (e.g. Paypal, Mastercard, Visa etc.), which primarily perform as a trustful entity and do lack transparency towards the end user, the SC Blockchain approach on the other hand is transparent, without central authority, and uses the defined functions in the Solidity programming language.

We integrated the SCs in our VC system in order to better understand the dynamic price monetization. The entities involved in the process are:

- the end user who initiates the VC service,

- the Blockchain component which provides SC execution,

- the solution services, and

- Cloud providers that actually provide the running infrastructure for the VC application components.

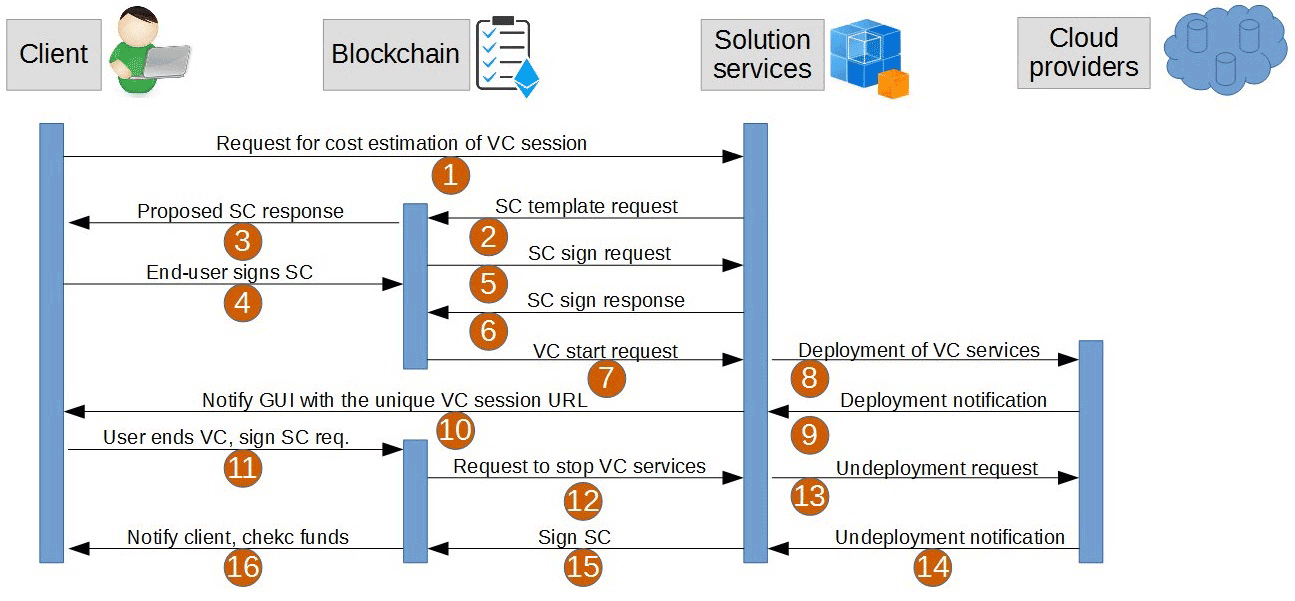

The flow of interactions between the Blockchain component and the triggering entities is depicted in Figure 6.1. In the beginning the end user sets basic properties through the Web GUI, for example the monetization type (dynamic price monetization), the maximum time period (one hour) and determines additional QoS preferences (availability \(99.8\%\), video quality high-definition).

Figure 6.1: Sequence diagram of the general VC use case

The process flow is explained in the following.

- Based on the end user’s properties, the VC solution services estimate the price for the end user, based on QoS/QoE history trends, and deploy an SC instance,

- The notification about the pricing policy is passed to the end user,

- who approves the SC agreement by paying the full incentive, locked in the SC, for one hour of Ethereum funds (ETH) through the Ethereum bridge MetaMask12, used as Web browser extension and monetization interface for ETH cryptocurrency.

- The signed SC notification is passed to the VC solution services,

- where it is signed by VC service address, and

- further passed as a deployment request to the solution services, to be more concrete the QoS Modeler and the Decision Maker.

- Further on, the deployment process is executed, and

- on success,

- the end user gets an unique Uniform Resource Locator (URL),

- that can be shared among other VC participants.

- Although it is a very common practice to share unique public URLs, this can be additionally enhanced, for example by registering individual participants addresses to obtain the VC session access. The VC session ends by the SC signature of the end user or the session automatically stops if one hour period is exceeded and no signing of SC is needed

- In the final stage the undeployment of CI application instances is executed.

- On success the final SC function, which unlocks ETH funds and executes proportional (time based) return of the ETHs or no return in case when time limit is exceeded. This step could be skipped but it is recommended as a final security check in case of any VC service anomalies (e.g. end user gets full refund in case when the availability of VC service dropped below \(75\%\)).

- see 13

- see 13

- Finally, the end user gets the notification about the completion of the SC.

In order to outline the SC template for the dynamic price monetization, it is mandatory to define the key global attributes – lock time in seconds determined by current block timestamp, session start time, maximum price (refereed to lock time in seconds), end user address and VC owner address. Due to the usage of block based generation of the timestamp, the overall delay is inducted between the discrete time generation of blocks which is on average 15 seconds13.

An important aspect is the management of event triggers which are not supported in Ethereum SCs. A good practice recommendation is to either develop the service on our own or simply use Ethereum’s Alarm Clock service14, which is designed for SC event purposes.

A fundamental SC template that locks the ETH funds of the sender is described in Algorithm 6.1.

\[\begin{align*} & \textbf{Data} \text{: object payable \{addressFrom, value\} } \\ & \textbf{Result} \text{: boolean success} \\ \\ & \textbf{if } basic\_conditions\_check \textbf{ then} \\ & \quad \text{// in case the ETH value does not match the agreed price} \\ & \quad \text{return false;} \\ & \textbf{else} \\ & \quad \text{// set the release time, address of the sender and deposit ETHs,} \\ & \quad \text{// while the lockTimeSeconds is a global attribute} \\ & \quad \text{releaseTime = currentBlockTime + lockTimeSeconds;} \\ & \quad \text{balance = balance + value;} \\ & \quad \text{globalAddressFrom = addressFrom;} \\ & \quad \text{return true;} \\ & \textbf{end} \end{align*}\]Another pillar function is the VC service stopping notification that is triggered by the end user. After the successful trigger the ETH transaction to the VC service address is performed and another one to the address of the end user accordingly to the duration of the VC.

7 Discussion and conclusion

The presented monetization approach in the previous section is overall less expensive compared to traditional monetization approaches. Beside the lower and relative fee policy not varying on the amount of funds to be sent, there are only initial integration costs and basically no further operational costs. Deployed and active SCs that temporary store the ETH funds of the end users, are accessible from the VC system APIs. However, the address containing the processed ETH funds owned by the VC system is stored in a cold storage wallet that make it secure in case of potential attacks.

This study presents a novel architecture that encapsulates Cloud principles and monetization possibilities through the usage of Blockchain. It is shown that SCs are suitable for establishing transparent mutual agreements among end users and VC system, and therefore facilitate the overall payment process without any additional cost for the service owners (e.g. bank, payment cards and other fees). Despite that, the specific SCs developed for the service needs to be carefully designed and validated (e.g. by using Oyente SC validation tool15), analysed and evaluated at different levels, such as code pattern comparison and simulation of actual usage with multiple parties on the same SC.

Following the implementation of our new architecture, we aim to investigate the QoS of the described monetization capabilities through performance measurements – actual transaction costs, block confirmation durations and other metrics related to the time metric.

The Cloud domain with Blockchain technology poses some very specific research challenges for real-time applications (e.g. VC) that need to fulfil or enhance the functional requirements but at the same time introduce new functionalities, such as monetization. In our use case where the system methodology follows the pay-as-you-go concept, a software is deployed on end user’s demand and SCs are used as an advanced agreement management tool among all stakeholders.

Acknowledgment

This project has received funding from the European Union’s Horizon 2020 Research and Innovation Programme under Grant Agreement No. 815141 (DeCenter project: Decentralised technologies for orchestrated cloud-to-edge intelligence).

References

Anjum, A., M. Sporny, and A. Sill. 2017. “Blockchain Standards for Compliance and Trust.” IEEE Cloud Computing 4 (4): 84–90. doi:10.1109/MCC.2017.3791019.

Ankenbrand, Thomas, and Bieri Denis. 2018. “A Structure for Evaluating the Potential of Blockchain Use Cases in Finance.” Perspectives of Innovations, Economics and Business 17 (2): 77–94. doi:10.15208/pieb.2017.06.

Bragagnolo, S., H. Rocha, M. Denker, and S. Ducasse. 2018. “SmartInspect: Solidity Smart Contract Inspector.” In 2018 International Workshop on Blockchain Oriented Software Engineering (IWBOSE), 9–18. doi:10.1109/IWBOSE.2018.8327566.

Buterin, V. 2015. “Ethereum White Paper, A Next-Generation Smart Contract and Decentralized Application Platform.” https://github.com/ethereum/wiki/wiki/White-Paper.

Gec, Sandi, Uroš Paščinski, and Vlado Stankovski. 2018. “Semantics for the Cloud: The ENTICE Integrated Environment and Opportunities with Smart Contracts.” doi:10.5281/zenodo.1163999.

Haber, Stuart, and W. Scott Stornetta. 1991. “How to Time-Stamp a Digital Document.” Journal of Cryptology 3 (2): 99–111. doi:10.1007/BF00196791.

Lu, Q., and X. Xu. 2017. “Adaptable Blockchain-Based Systems: A Case Study for Product Traceability.” IEEE Software 34 (6): 21–27. doi:10.1109/MS.2017.4121227.

Nakamoto, Satoshi. 2008. “Bitcoin: A Peer-to-Peer Electronic Cash System.” http://bitcoin.org/bitcoin.pdf.

Paščinski, Uroš, Jernej Trnkoczy, Vlado Stankovski, Matej Cigale, and Sandi Gec. 2018. “QoS-Aware Orchestration of Network Intensive Software Utilities Within Software Defined Data Centres.” Journal of Grid Computing 16 (1): 85–112. doi:10.1007/s10723-017-9415-1.

Peter, Haiss, and Andreas Moser. 2017. “Blockchain-Applications in Banking & Payment Transactions: Results of a Survey.” In European Financial Systems 2017, Proceedings of the 14th International Scientific Conference Pt 2, edited by Nesleha, J and Plihal, T and Urbanovsky, K, 141–49. Brno, Czech Republic: Masaryk Univ, Fac Econ & Adm, Dept Finance; Inst Financial Market.

Sillaber, Christian, and Bernhard Waltl. 2017. “Life Cycle of Smart Contracts in Blockchain Ecosystems.” Datenschutz Und Datensicherheit - DuD 41 (8): 497–500. doi:10.1007/s11623-017-0819-7.

Swan, Melanie. 2017. “Anticipating the Economic Benefits of Blockchain.” Technology Innovation Management Review 7 (10): 6–13. doi:10.22215/timreview/1109.

Yoo, Soonduck. 2017. “Blockchain Based Financial Case Analysis and Its Implications.” Asia Pacific Journal of Innovation and Entrepreneurship 11 (3): 312–21. doi:10.1108/APJIE-12-2017-036.